Life Insurance in and around Blue Island

Protection for those you care about

Life happens. Don't wait.

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

When you're young and a recent college graduate, you may think Life insurance isn't necessary when you're still young. But it's a great time to start looking into Life insurance to prepare for the unexpected.

Protection for those you care about

Life happens. Don't wait.

Their Future Is Safe With State Farm

Coverage from State Farm helps you rest easy knowing your family will be taken care of even if the worst comes to pass. Because most young families rely on dual incomes, the loss of one salary can be completely devastating. With the many expenses that come with raising children, life insurance is an indispensable need for young families. Even if you or your partner do not have an income, the costs of replacing daycare or domestic responsibilities can be sizeable. For those who haven't had children, you may have aging parents who rely on your income or have a partner who is unable to work.

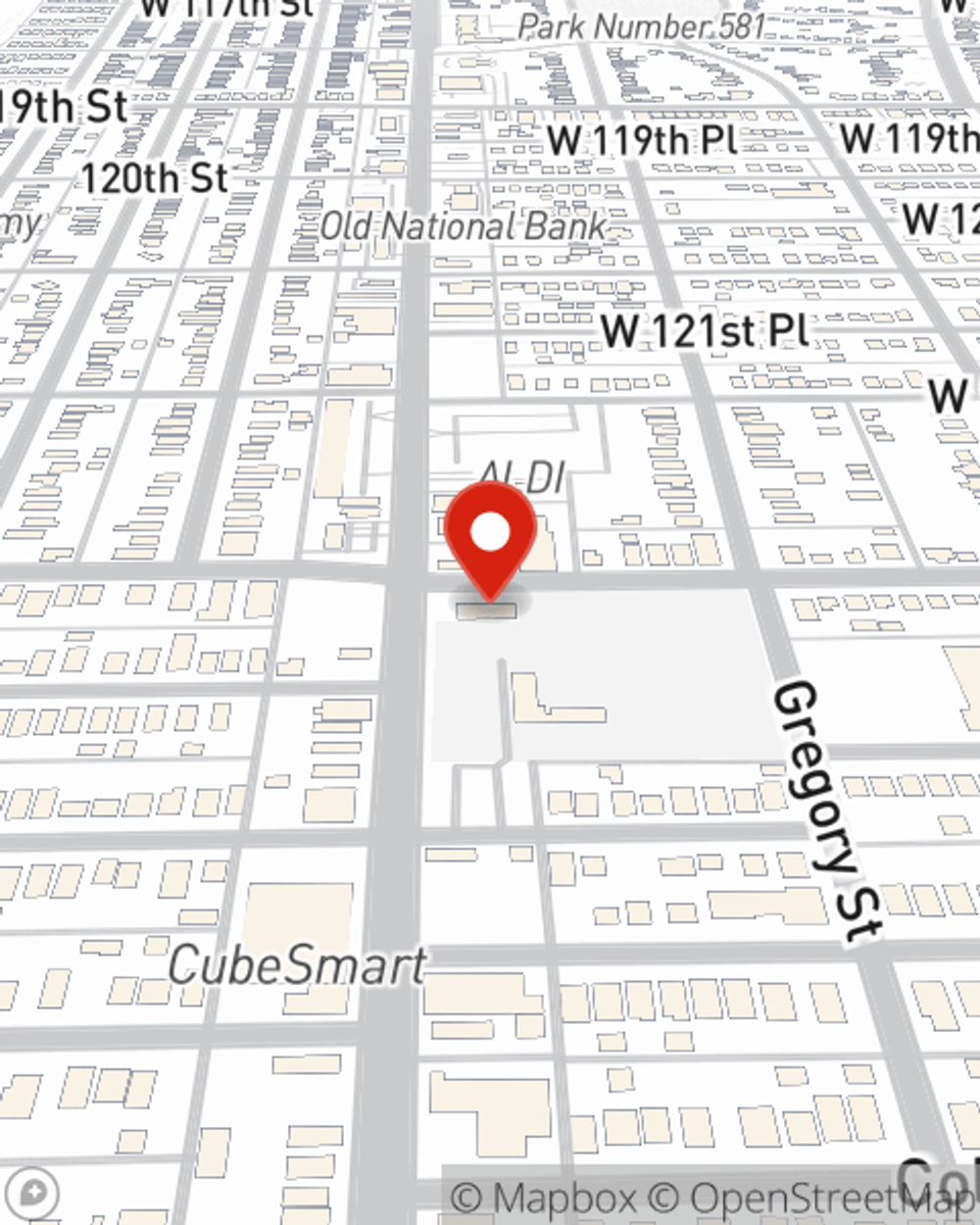

As a reliable provider of life insurance in Blue Island, IL, State Farm is ready to be there for you and your loved ones. Call State Farm agent Renato Delgadillo today for help with all your life insurance needs.

Have More Questions About Life Insurance?

Call Renato at (708) 385-3627 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

Renato Delgadillo

State Farm® Insurance AgentSimple Insights®

Whole Life insurance

Whole Life insurance

What is the difference between Ordinary life and Limited-payment life? Read about some common uses for Whole Life Insurance.

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.